Have you ever driven a brand-new car off the lot, feeling a mix of excitement and anxiety? You’re not alone.

The thrill of a new ride often comes with concerns about protecting your investment. Imagine this: you’re cruising along, and suddenly, life throws you a curveball—a car accident. Your regular insurance might not cover the full amount you owe on your car loan.

This is where gap insurance steps in. But is it really worth the extra cost? We’ll dive into what gap insurance is, how it works, and whether it’s a smart move for you. Stick around to discover if this little-known insurance could be your financial lifesaver, providing peace of mind as you enjoy the open road.

Credit: www.copilotsearch.com

What Is Gap Insurance?

When buying a car, understanding insurance options is crucial. One such option is gap insurance. It’s essential to know what it covers and why it might be necessary.

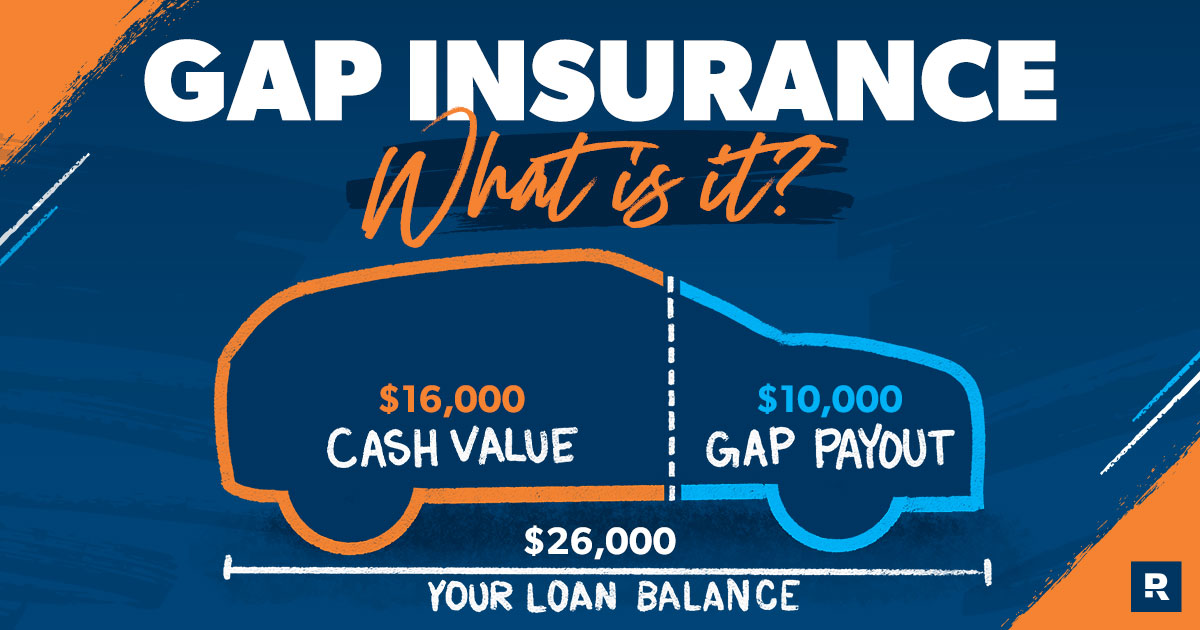

Gap insurance stands for “Guaranteed Asset Protection.” This coverage helps when your car is totaled or stolen. It pays the difference between the car’s current value and what you owe on it.

New cars lose value quickly. If your car is damaged, regular insurance pays only the market value. You might still owe more on your loan. That’s where gap insurance steps in.

Without gap insurance, you could pay thousands out-of-pocket. It protects your financial stability by covering the shortfall.

Why Do People Consider Gap Insurance?

Many drivers choose gap insurance for peace of mind. It is especially helpful for those with long loan terms or small down payments. When a car’s value drops faster than the loan balance, gap insurance prevents unexpected expenses.

Car owners with high depreciation rates find gap insurance useful. If a car is leased, gap insurance often becomes mandatory. Leasing companies want to ensure their investment is protected.

How Does Gap Insurance Work?

Gap insurance works alongside your regular car insurance. After an accident, your insurer calculates the payout based on the car’s value. If the payout is less than what you owe, gap insurance covers the difference.

This insurance is generally inexpensive. Many providers offer it, making it easy to find a policy that fits your needs.

Who Needs Gap Insurance?

Gap insurance is beneficial for certain drivers. Those with new cars or high loan balances often need it. If you have little equity in your vehicle, gap insurance provides necessary protection.

Drivers who want financial security should consider it. Gap insurance ensures you won’t face large bills after a car loss.

Credit: www.ramseysolutions.com

How Gap Insurance Works

Understanding how gap insurance works can save you money and stress. Many car owners overlook this important coverage. It fills the gap between what you owe and your car’s value. This becomes crucial if your car is totaled or stolen. Curious about the mechanics? Let’s dive into the specifics.

What Does Gap Insurance Cover?

Gap insurance covers the difference between your car loan balance and the car’s current value. Regular insurance pays out the market value of your car. Sometimes, this amount is less than what you owe on your loan. That’s where gap insurance steps in. It pays the remaining balance, so you’re not stuck paying for a car you no longer have.

When Is Gap Insurance Useful?

Gap insurance is useful for new cars or leased vehicles. New cars lose value quickly. After driving off the lot, depreciation occurs fast. If your car gets totaled soon after purchase, you could owe more than it’s worth. Gap insurance helps cover this shortfall. Leased cars also benefit because of strict lease terms.

Buying gap insurance is simple. You can get it from the dealership, your lender, or an insurance company. Dealerships offer it during the car purchase process. Lenders include it in your loan package. Insurance companies offer it as an add-on to your existing policy. Compare costs and choose what fits your budget best.

Factors Influencing Gap Insurance Cost

Several factors influence the cost of gap insurance. The car’s make and model play a role. The length of your loan affects the price. Even your location can impact costs. Generally, gap insurance is affordable. It’s a small price for the peace of mind it offers.

Types Of Gap Insurance

Understanding the types of gap insurance can be crucial for car owners. Gap insurance covers the difference between the car’s value and the remaining loan balance. This financial safety net can be a lifesaver in certain situations. Let’s explore the different types of gap insurance available.

Finance Gap Insurance

Finance gap insurance is useful for those with car loans. It covers the gap between the loan amount and the car’s actual value. If a car is totaled or stolen, it ensures you don’t owe extra money. This type of insurance helps avoid financial stress after an accident.

Lease Gap Insurance

Lease gap insurance is designed for leased vehicles. It covers the difference between the lease amount and the car’s value. If a leased car is damaged or lost, this insurance protects you from paying a hefty sum. It’s ideal for maintaining financial stability during the lease term.

Return-to-invoice Gap Insurance

Return-to-invoice gap insurance offers peace of mind. It covers the gap between the car’s current value and its original price. If a vehicle is stolen or wrecked, this insurance pays the invoice price. It ensures you can replace the car without financial strain.

Credit: www.ala.co.uk

Benefits Of Gap Insurance

Gap insurance covers the difference between your car’s value and the amount you owe. This protection is crucial after an accident or theft. Without gap insurance, you might end up paying from your pocket for a car you no longer have.

Gap insurance can be a lifesaver when you least expect it. Many drivers overlook the benefits, thinking it’s just another add-on. Yet, when your car is totaled or stolen, and the regular auto insurance payout falls short of what you owe on your loan or lease, gap insurance steps in to cover the difference. Below, we dive into the key benefits of having gap insurance.Financial Protection

Gap insurance offers solid financial protection. Imagine buying a new car and, just months later, getting into an accident that totals it. Your standard insurance might cover the current value of the car, but what if you owe more on your loan? Gap insurance covers that shortfall, saving you from unexpected financial strain.Peace Of Mind

Driving a new car can be a joyous experience, but the worry of potential accidents can linger. Knowing you have gap insurance can ease that anxiety. It provides peace of mind, reassuring you that you’re protected financially if the worst happens. This can be especially comforting for those with tight budgets.Protection Against Depreciation

Cars depreciate quickly, often losing value the moment they leave the dealership. Gap insurance safeguards you against this rapid depreciation. If your vehicle is stolen or totaled, you’re protected from the financial hit of your car’s decreased value. This means you won’t be stuck paying for a car you no longer have. Isn’t it worth considering the financial security and peace of mind that gap insurance provides? It might just be the safety net you didn’t know you needed.Who Should Consider Gap Insurance

Considering gap insurance? It’s not for everyone. But, for specific car owners, it can be a financial lifesaver. Let’s explore who should consider gap insurance under different circumstances.

New Car Buyers

New car buyers often face rapid depreciation. Cars lose value quickly, especially in the first year. If your car is totaled, the insurance payout might be less than the loan amount. Gap insurance covers the difference, protecting your finances.

Leased Vehicle Owners

Leased vehicles can be expensive to replace. Lease agreements usually have strict terms. If your leased car is stolen or wrecked, gap insurance can cover the shortfall. This helps avoid extra costs and penalties.

High-interest Loan Holders

High-interest loans make paying off a car challenging. The loan balance can exceed the car’s worth over time. Gap insurance steps in to cover the gap, easing financial stress. This ensures you’re not stuck paying for a car you no longer have.

Cost Factors Of Gap Insurance

Gap insurance cost depends on several factors like your car’s value, loan terms, and insurance provider. Higher vehicle prices often lead to increased premiums. Understanding these factors helps determine if gap insurance is a wise investment for protecting your financial interests.

When considering whether gap insurance is a worthy investment, understanding the cost factors is crucial. Gap insurance is designed to cover the difference between what you owe on your vehicle and its actual cash value in case of a total loss. However, not all policies are created equal, and various elements can affect the price. Let’s break down these factors so you can make an informed decision. ###Vehicle Value

The value of your vehicle plays a significant role in determining the cost of gap insurance. High-value vehicles often require more expensive coverage. This is because the gap between the loan balance and the car’s worth can be larger. Consider how quickly your vehicle depreciates. New cars lose value rapidly, and this depreciation impacts the potential gap. If you’re buying a luxury car, the need for gap insurance could be more pronounced due to its steep depreciation curve. ###Loan Terms

Your loan terms also influence the cost of gap insurance. Longer loan terms can increase the gap because it takes longer for your payments to catch up with depreciation. Imagine financing a car over 72 months. Initially, you might owe more than the car is worth, making gap insurance a smart choice. On the other hand, a shorter loan term may reduce or eliminate the gap, potentially saving you money on insurance. ###Insurance Provider

Different insurance providers offer varying rates for gap insurance. Some might bundle it with your auto insurance policy, offering a discount. Others might charge a premium, especially if you buy it from a dealership. Comparing quotes from multiple providers can help you find the best rate. Don’t just settle for the first offer; shop around to ensure you’re getting the most value for your money. Have you ever paid more than necessary because you didn’t compare options? Understanding these cost factors can guide you in deciding if gap insurance is worth it for your specific situation. Making an informed choice can save you money and provide peace of mind.Common Misconceptions

Many people misunderstand gap insurance. They think it’s unnecessary or a waste. But misconceptions can lead to costly mistakes. Let’s clear up some confusion.

Comprehensive Insurance Coverage

Some believe comprehensive insurance covers everything. It doesn’t. Comprehensive insurance covers damage from non-collision events. But it won’t cover the gap between your car’s value and loan balance. Gap insurance fills this gap. Without it, you might owe more than your car’s worth.

Value In Older Cars

Many think gap insurance is only for new cars. Not true. Older cars can lose value quickly. If you owe more than the car’s value, gap insurance helps. It protects you from paying out-of-pocket if the car is totaled. So, even older cars can benefit from gap insurance.

How To Purchase Gap Insurance

Deciding to buy gap insurance can protect you from unexpected expenses. It covers the difference between what you owe on a car loan and the car’s value. This is especially useful if your car gets totaled or stolen. Understanding how to buy gap insurance is crucial. There are several options available that cater to different needs and preferences.

Through Auto Dealers

Many auto dealers offer gap insurance at the point of sale. It’s convenient to purchase it while buying a car. Dealers may provide it as part of the financing package. Ask about the terms and conditions. Compare their offer with other options. Ensure you understand the coverage provided. Some dealer policies might be more expensive. So, it’s wise to check thoroughly.

Via Insurance Companies

Insurance companies often provide gap insurance as an add-on. Contact your car insurance provider directly. They can explain the coverage and costs. This can be a more affordable option. It’s integrated with your existing insurance policy. Sometimes, insurers offer discounts for bundling policies. Speak to an agent for a personalized quote. Read the fine print carefully.

Online Options

Buying gap insurance online is simple. Many companies offer competitive rates on their websites. Research different providers and compare offers. Online options often have user reviews and ratings. These can help in making informed decisions. Fill out an online form to get quotes. Ensure the provider is reputable. Look for customer service contact details. Online purchasing saves time and effort.

Alternatives To Gap Insurance

Car buyers often explore gap insurance for financial peace. Yet, gap insurance isn’t the only choice. There are other viable options worth considering. These alternatives could provide the coverage you need.

Loan/lease Payoff Coverage

Loan/lease payoff coverage is one option. It works similarly to gap insurance. It covers the difference between your car’s value and the loan balance. This coverage often comes as an add-on with auto insurance policies. It might offer better rates than standalone gap insurance. Check with your insurer to see if they offer this option. Compare the costs and benefits.

Self-insurance Strategies

Some people prefer self-insurance strategies. This involves saving money for potential losses. Create a savings plan dedicated to car expenses. This fund can cover any outstanding loan balance after a car loss. It requires discipline but offers full control over your money. You avoid the extra cost of insurance premiums. Evaluate your financial situation before choosing this route.

Evaluating Your Need For Gap Insurance

Evaluating your need for gap insurance might seem daunting, but it is an essential step in ensuring your financial security. Gap insurance covers the difference between your car’s actual cash value and the remaining amount on your loan or lease, offering peace of mind in the event of an accident or theft. Understanding whether this coverage is necessary for your situation requires careful consideration of several factors.

Assessing Personal Risk

Consider your driving habits and environment. Are you commuting long distances or navigating busy urban streets daily? More exposure increases the likelihood of accidents, making gap insurance more relevant. Reflect on past incidents or near-misses. If you’ve experienced these, gap insurance might be worth considering.

Think about the car you drive. Newer models can depreciate quickly, leaving a gap between what you owe and its current value. If you recently purchased or leased a new vehicle, this insurance can save you from unexpected financial burdens. Do you feel confident about handling large expenses out of pocket in case your car is totaled or stolen?

Financial Stability Considerations

Evaluate your current financial situation. Can your budget handle a significant loss if your car is no longer available? If juggling multiple financial commitments, gap insurance may provide a safety net. Consider your savings; are they enough to cover a sudden gap between your car’s value and loan amount?

Look at your loan or lease details. High-interest rates or long-term loans often result in greater discrepancies between your car’s worth and what you owe. Check if your lender requires gap insurance; some mandates may guide your decision. How prepared are you to face such financial challenges without this coverage?

By weighing these factors, you can determine whether gap insurance is a prudent choice for you. Address your unique situation and make informed decisions to protect your assets effectively.

Frequently Asked Questions

What Is Gap Insurance?

Gap insurance covers the difference between your car’s value and what you owe on it. If your vehicle is totaled or stolen, it can save you from paying out of pocket. This insurance is ideal if you owe more on your car loan than your car’s current market value.

How Does Gap Insurance Work?

Gap insurance pays the remaining balance on your car loan if your car is totaled or stolen. It covers the difference between your car’s depreciated value and the amount you still owe. This insurance is especially useful for new cars that depreciate quickly.

Who Should Consider Gap Insurance?

Gap insurance is ideal for car owners with high loan balances or leases. It’s beneficial if you have a long-term loan or made a small down payment. Those driving new cars that depreciate quickly should also consider it. It provides financial protection and peace of mind.

Is Gap Insurance Worth The Cost?

Gap insurance can be worth the cost for many drivers. It provides coverage if your car is totaled or stolen, saving you from paying the difference. Consider your loan balance and car depreciation rate to decide. It offers valuable protection against financial losses.

Conclusion

Deciding on gap insurance needs careful thought. It offers extra protection. Especially if your car loan is high. Accidents can happen anytime. Regular insurance might not cover everything. That’s where gap insurance helps. It covers the difference. Consider your car’s value and loan balance.

Do the math. Compare costs and benefits. For some, it’s peace of mind. Others might not need it. Think about your situation. Consult with experts if needed. Make an informed choice. It’s your financial safety net.