Excess protection can provide peace of mind. But is it really necessary?

Deciding whether to invest in extra coverage can be confusing. Many people wonder if the benefits justify the cost. Excess protection typically covers unexpected expenses that go beyond standard insurance. It can include rental car damage, travel cancellations, or higher medical bills.

People often face this choice when renting cars or booking vacations. The idea is simple: pay a bit more now to avoid big bills later. But not everyone needs it. Some might already have coverage through existing policies. Others might find the extra cost too high. This blog will help you decide if excess protection is worth it for you. We will weigh the pros and cons to make the choice clearer.

Evaluating Excess Protection

Understanding your coverage needs is important. Think about what you want. Basic plans cover only a few things. Excess protection gives more help. It covers extra costs. This means more safety for you. Are you worried about big bills? Then, extra protection might be good for you. Check what you have now. Do you need more help? Think about the future. Plan for unexpected costs. Make sure you feel safe with your choice.

Standard plans are simple. They cover basic needs. Excess plans offer more. They help with extra costs. Sometimes, these costs are big. Do you have savings? Can you pay for surprises? If not, consider excess protection. It gives peace of mind. You pay a little more. But you get more coverage. Is it worth the extra money? Decide based on your needs. Compare both plans. Pick what fits you best.

Financial Security

Excess protection can help save money on big bills. It covers costs that might surprise you. This means you might not need to pay as much from your own pocket. This can be important during unexpected times. Many people feel safer knowing they have this protection. It acts like a safety net for your finances.

Life can be full of surprises. Some surprises cost a lot of money. Excess protection helps cover these unexpected costs. This can be a big relief for many families. Knowing you have this coverage can ease your mind. It helps you plan better for the future. This way, sudden costs don’t become a big worry.

Peace Of Mind

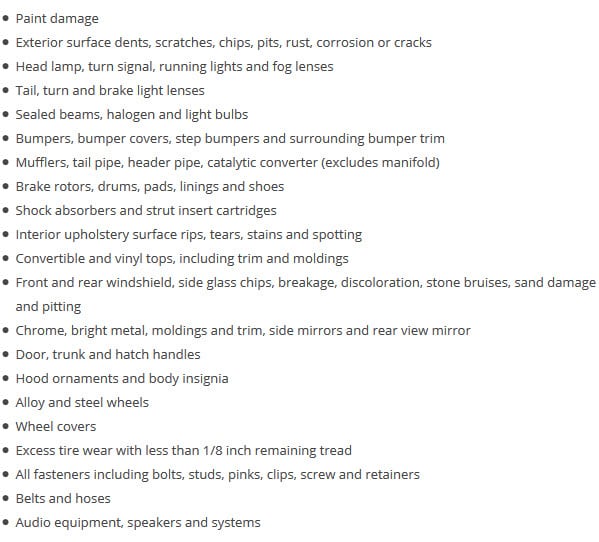

Excess protection offers extra safety for your insurance. It covers the costs not covered by basic plans. This means you won’t pay much if things go wrong. Imagine your car gets damaged. Basic insurance may not cover all repairs. Here, excess protection helps. It pays what basic insurance doesn’t. This way, you can relax and feel secure.

Insurance gaps can leave you vulnerable. With excess protection, these gaps shrink. You get more complete coverage. Think of it as an extra layer of safety. Without it, you might face big bills. This makes excess protection a wise choice. It shields you from unexpected costs. It keeps your finances safe.

Cost-benefit Analysis

Premium costs can be tricky. Monthly payments add up quickly. Excess protection might seem expensive at first. But why pay more? Some people feel safer with it. They think it saves money later. Others think it’s a waste. Understanding costs is important. Compare different plans carefully. Think about your needs. Do you often have accidents? Are your repair bills high? Costs might be worth it if yes.

Potential savings matter a lot. Excess protection can cover big repair bills. Imagine paying less for accidents. Think of the money saved. It can be helpful during bad times. Lower repair costs can mean more savings. But only if you need it often. Calculate how much you save each year. Compare that to what you pay in premiums. This helps in making a smart choice.

Long-term Implications

Excess protection can change how you plan your money. It means paying more now to feel safe later. But, will it help you save money later? It can be hard to know. Some people think it’s a good idea. Others feel it’s too much money. It might help you sleep better. Still, it’s important to think about your own needs. Everyone’s money plan is different. What works for one person might not work for you. Think about what you need. Then decide if it’s worth it.

Life is full of changes. Excess protection might help you feel ready. It can cover surprises that life brings. But, it might also mean less money for fun things. Think about big changes like getting a new job or moving. These can change what you need. It’s important to think about how you want to use your money. Maybe you need more protection now. Or maybe you need less. Always think about your own life. Then make a choice that feels right.

Personalized Protection

People need different protection levels. Some prefer basic plans. Others choose detailed coverage. Individual needs shape these choices. Families might need special coverage. Single individuals might need less. Age and lifestyle also affect choices. Older people might need more medical coverage. Younger people might need travel protection. Customizing plans helps ensure safety. Protection fits personal situations.

Coverage levels can be adjusted. Basic plans cover essential needs. Extended plans offer more benefits. People can choose what they need. Customizing helps save money. Too much coverage costs more. Too little coverage risks problems. Finding the right balance is key. Protection should match personal risks. This ensures peace of mind.

Market Trends

Excess protection is growing fast. Many people want extra safety. They worry about high costs. So, they seek more coverage. This trend boosts insurance sales. Demand for excess protection is rising. Companies notice the change. They adjust their plans.

Insurance products are changing. New ideas are emerging. They offer fresh options. Companies innovate to meet needs. Customers look for better deals. They want value for money. So, insurers create new solutions. These products are more flexible. They fit different budgets. People appreciate these innovations.

Making An Informed Decision

Talking to insurance experts helps a lot. They know many things. Experts explain policies in simple words. They answer questions about costs. They can tell if excess protection is a good choice. Their advice saves money and stress. Peace of mind is important.

Everyone has different risks. Some people drive more than others. Accidents happen more if you drive a lot. Living in busy places can be risky. More cars mean more chance of crashes. Think about your habits. Are you a safe driver? How often do you travel? These questions help decide on excess protection. Personal risks matter in making choices.

Frequently Asked Questions

Is It Better To Have Excess Or No Excess?

Having excess can lower insurance premiums but increase out-of-pocket costs in claims. No excess means higher premiums but no additional costs during claims. Choose based on your financial situation and risk tolerance. Evaluate the cost-benefit and decide what aligns best with your budget and needs.

Should You Take Excess Protection On A Hire Car?

Taking excess protection on a hire car can offer peace of mind. It covers potential damages or theft, reducing your financial liability. Consider your travel plans and personal insurance coverage to decide. It’s often a wise choice if you’re driving in unfamiliar or high-risk areas.

Should I Get Excess Protection Enterprise?

Consider excess protection if you want financial peace of mind. It covers unexpected costs beyond regular insurance. Review your business needs and budget to decide. This protection can save money on unforeseen expenses. Always compare different providers for the best coverage and rates.

Should I Pay For The Extra Insurance On A Rental Car?

Evaluate your current insurance coverage first. Many policies include rental car coverage. Credit cards might offer protection too. Consider additional insurance if you lack coverage or want peace of mind. Assess the cost and benefits before deciding. Always read the rental agreement’s fine print.

Conclusion

Deciding on excess protection can be tough. Weigh the costs and benefits. Think about your needs. Some find peace of mind worth the cost. Others might not. Consider your risk tolerance. Also, check your budget. It’s about personal choice. Everyone’s situation is different.

Make an informed decision. Ask questions if unsure. Research helps a lot. Consider expert advice if needed. Protecting your assets is important. But not at any cost. Balance is key. Choose wisely for your circumstances.