Yes, CeMAP is worth it for aspiring mortgage advisors. It provides essential knowledge and skills needed in the industry.

But what makes it truly valuable? CeMAP, or the Certificate in Mortgage Advice and Practice, is a respected qualification in the UK. Many aspiring mortgage advisors consider it a must-have. It equips you with the necessary understanding of the mortgage market.

It covers regulations, customer needs, and practical advice delivery. This qualification opens doors to career opportunities in banks and financial institutions. It’s often seen as a critical step for those looking to specialize. So, is CeMAP worth the investment of time and money? Understanding its benefits and potential impact on your career can help answer that. Let’s explore what CeMAP offers and how it can support your career goals.

Introduction To Cemap

Cemap stands for Certificate in Mortgage Advice and Practice. It is a qualification. People in the UK take it to become mortgage advisors. This certification is important. It shows that someone knows about mortgages. It covers rules and regulations. It also includes practical knowledge.

Cemap is vital in the financial world. Many banks and lenders require it. It helps professionals give better advice. Customers trust advisors with Cemap. They know these advisors are qualified. The certification opens doors to many jobs. It is respected in the financial industry. Having Cemap can lead to a successful career.

Benefits Of Cemap Certification

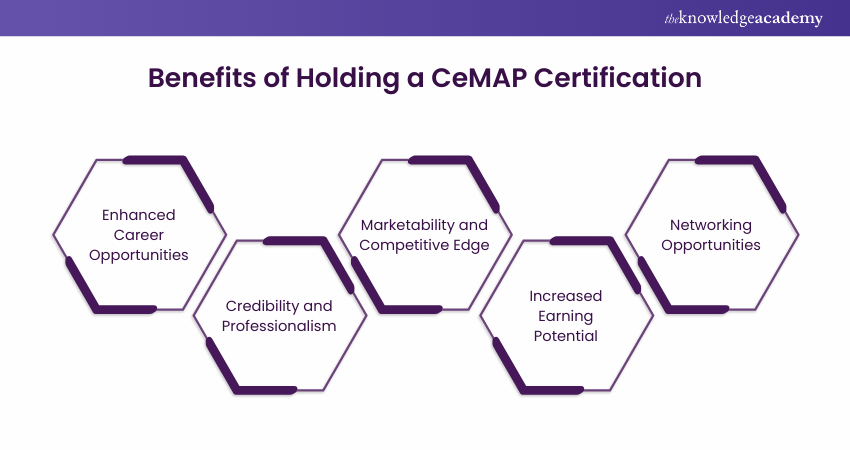

Gaining a Cemap certification can open doors in the finance world. It helps you stand out among peers. Employers often look for this qualification. It shows you know the basics of mortgage advice. New jobs and roles may become available. You can even get promoted faster. This certification proves your skills and knowledge. It can be a stepping stone to a brighter future.

Cemap is well-known in the finance industry. Many companies recognize its value. It shows you have met high standards. This can lead to more trust from employers. Clients also feel more confident in your advice. Having this recognition can boost your career. It builds a strong reputation. People respect those with a Cemap certification.

Cost And Investment

Cemap courses need some money. Course fees can be a big part. You also need to buy study materials. Sometimes there are exam fees too. Try to save for other costs. These can be travel or food. Think of these as part of the learning journey.

Learning for Cemap takes time. You may need months to study. Daily study is important. Even short study times help. Balance study with other things. Free time might be less. But the learning can be worth it.

Cemap Curriculum

Cemap offers three main modules. Each module covers important topics. The first module teaches the basics of financial services. It includes laws and regulations. The second module focuses on mortgages. It explains how mortgages work. The third module covers customer service. It teaches how to help clients effectively.

Specialized topics provide deeper knowledge. They cover complex subjects. Topics include risk assessment and mortgage advice. These subjects are crucial for financial careers. Understanding them aids in professional growth. These topics help in making informed decisions.

Exam Structure

Cemap exams are structured into modules, covering key financial advice topics. Each module tests understanding through multiple-choice questions. This setup helps learners grasp mortgage advice essentials effectively.

Assessment Format

The Cemap exam has three main parts. Each part tests a different skill. The exam is mostly multiple-choice questions. This format helps test your knowledge clearly. Each question has four possible answers. Only one answer is correct. There are no tricky questions. The questions are clear and direct. Practice tests can help a lot. They help you get used to the format.

Passing Criteria

To pass, you need a score of 70% or higher. Each section has its own pass mark. You must pass all sections to succeed. If one section is failed, retake is needed. You can retake the exam multiple times. There is no limit to retakes. This helps improve your confidence. Practice and study are key to passing.

Job Opportunities

CeMAP opens doors to many roles in mortgage advice. With this certificate, you can work as a mortgage advisor. Help people find the best loans for their homes. You can become a mortgage broker. Brokers connect clients with lenders. Explain loan details clearly. Ensure clients understand all terms. Some choose to be a financial consultant. Give advice on managing money wisely. These roles offer steady work. Many banks and companies hire CeMAP professionals. Good pay and job security.

CeMAP creates chances in the banking sector. Work as a bank advisor. Assist clients with their financial needs. Share knowledge about savings and investments. Some CeMAP holders become bank managers. Lead teams and oversee branch operations. Customer service roles are available too. Help clients with their accounts. Solve banking issues promptly. Banking jobs offer stable careers. Many banks value CeMAP certification. This means better job options. CeMAP makes finding bank jobs easier.

Success Stories

Many find success with CeMAP certification, boosting their careers in mortgage advice. This qualification opens doors to better job opportunities. It offers essential knowledge, making it a valuable investment for aspiring professionals in the finance sector.

Career Transformation

Many people have changed their careers with the CeMAP qualification. This certificate helps them work in the finance field. Some students start new jobs in banks. Others find roles in mortgage advice. This change gives them better job security. It also opens up new opportunities.

The training improves their skills. It makes them confident in their work. People can help others with money decisions. This is important in today’s world. They feel proud of their new roles. Their hard work pays off with success.

Real-world Impact

The CeMAP course brings real benefits. It helps people understand mortgages better. This knowledge aids them in solving real problems. Clients trust advisors with CeMAP training. They provide good advice and support. This trust leads to loyal clients.

Advisors with CeMAP can help families buy homes. This makes a big impact on communities. It also boosts the advisor’s career. Their work improves the lives of many people. The benefits are clear and meaningful.

Is Cemap Right For You?

Cemap helps in gaining financial knowledge. It is useful for personal growth. People who love numbers might like it. It is a good choice for those interested in finance. Learning Cemap can be fun. It opens doors to new opportunities. It is also valuable for personal budgeting. You can save money with better skills. Understanding mortgages becomes easier. This knowledge is helpful in everyday life.

Cemap is a great step for a finance career. It helps in getting a good job. Many employers value Cemap certification. It shows dedication to learning. It can lead to higher pay. Cemap is useful in banks and finance firms. It is beneficial for mortgage advisors. This certification is recognized widely. It boosts confidence at work. Cemap helps in achieving career goals.

Frequently Asked Questions

Is The Cemap Worth It?

CeMAP is worth it for aspiring mortgage advisors. It enhances credibility and increases job opportunities in the financial sector. Recognized by employers, it equips professionals with essential mortgage knowledge. Completing CeMAP can lead to a rewarding career in mortgage advising.

How Quickly Can You Pass Cemap?

You can pass CeMAP in 6 to 12 weeks with dedicated study. Many complete it part-time while working. Focused preparation and consistent study sessions help achieve success quickly. Choose reputable training providers for structured learning.

Is Cemap Qualified Or Equivalent?

CeMAP is a recognized qualification in the UK mortgage industry. It is not directly equivalent to any other qualification. CeMAP is specifically designed for those seeking a career as a mortgage adviser. It meets the standards set by the Financial Conduct Authority (FCA) for advising on mortgage products.

Is Cemap 2 Hard?

CeMAP 2 is challenging for some, but manageable with preparation. Focus on understanding complex topics like mortgages and regulations. Utilize study materials and practice tests. Many find success through dedicated study and support. Balancing study time and practice can make passing CeMAP 2 achievable.

Conclusion

Cemap can be a good choice for aspiring mortgage advisors. It offers valuable knowledge and skills. Many find it beneficial for career growth. The qualification can open doors in the financial sector. But it requires time, effort, and investment. Consider your career goals and resources.

Weigh the pros and cons carefully. Is it the right step for you? The decision is personal. Research thoroughly before committing. Cemap might be the boost you need. Or maybe it’s not necessary for your path. Reflect on your needs and make an informed choice.