Imagine a future where you can finally take that dream vacation, pursue hobbies, or simply relax without financial worries. Sounds perfect, right?

But achieving this peaceful retirement requires planning, and that’s where pensions come in. You might be wondering if it’s truly worth paying into a pension for just five years. This question is more common than you might think, and the answer could surprise you.

By understanding the potential benefits and drawbacks, you can make an informed decision that aligns with your financial goals. Keep reading to discover how a short-term commitment to a pension could impact your future and why it might just be the smartest move you make today.

Pension Basics

Understanding pensions can be confusing. They are important for securing your future. Knowing how pensions work helps you plan better. Let’s break it down into simple terms.

What Is A Pension?

A pension is a savings plan for retirement. You save money while working. This money supports you after retirement. It acts like a paycheck after you stop working.

Types Of Pension Plans

There are different pension plans. The most common are state and private pensions. State pensions are provided by the government. Private pensions are managed by companies or individuals. Each type has its own benefits.

How Pensions Work

Pensions work by saving money regularly. You contribute a part of your salary. This money is invested over time. The goal is to grow your savings. Upon retirement, you receive payments from your savings. These payments help you maintain your lifestyle.

Short-term Pension Contributions

Short-term pension contributions might seem insignificant at first glance, especially when compared to decades-long investment plans. Yet, even a five-year commitment can offer surprising benefits. Whether you’re nearing retirement or just testing the waters, this brief period can pack quite a punch. Let’s dive into why these contributions can be a smart move.

Five-year Contribution Period

Investing in a pension for just five years might sound like a drop in the ocean. But consider this: every penny you add compounds over time. It’s not just about the amount you put in; it’s about the growth potential. Even a modest investment can grow significantly, thanks to compound interest.

Imagine setting aside a small portion of your salary consistently for five years. You’ll build a solid foundation for your future. It’s about creating a habit of saving and understanding the power of consistency.

This period is also ideal if you’re uncertain about your long-term financial plans. It offers flexibility. You can reassess and make informed decisions about increasing contributions or exploring other investment avenues.

Potential Benefits In A Short Timeframe

What can five years really do for your pension? The potential benefits might surprise you. First, there’s the immediate tax relief. Your contributions reduce your taxable income, which can save you money each year.

Then there’s the employer contribution. Many employers match a portion of your pension contributions. It’s essentially free money added to your savings. Imagine boosting your pension without extra effort.

Consider also the emotional peace of mind. Knowing you’re building a nest egg—even for just five years—can relieve financial stress. It’s empowering to take control of your financial future.

Have you ever thought about how these benefits stack up over time? Even short-term contributions can lay the groundwork for a more secure retirement. Are you ready to see the impact of a five-year plan?

Financial Advantages

Paying into a pension for five years can offer significant financial advantages. Many individuals overlook these benefits, yet they can enhance your financial stability. Understanding how pensions work can help you make informed decisions. Let’s explore some key financial advantages that make pension contributions worthwhile.

Tax Benefits

Contributing to a pension often provides tax relief. This means part of your income goes untaxed. The more you contribute, the less tax you pay. This helps you save money while preparing for retirement. Tax advantages make pensions a smart financial strategy.

Employer Contributions

Many employers offer contributions to your pension. This is essentially free money towards your retirement. Matching contributions from employers can greatly increase your pension pot. This boosts your savings without extra effort on your part. A great reason to start paying into a pension.

Compound Interest Impact

Compound interest helps your savings grow exponentially. Money in your pension earns interest over time. The longer it stays, the more it grows. Even small contributions can lead to significant growth. Over five years, compound interest can considerably boost your pension value.

Credit: www.ppines.com

Investment Growth Potential

Paying into a pension for five years can boost your future financial security. Even short-term contributions compound over time, enhancing retirement savings. Consider the growth potential and tax benefits when evaluating your investment options.

Investing in a pension plan for just five years might seem short, but it can offer significant growth potential. The power of compounding, even over a relatively brief period, can enhance your savings. Understanding how your investment can grow is crucial in making informed decisions about your financial future.Market Fluctuations

Market conditions can directly impact the growth of your pension fund. Stocks and bonds, common components of pension investments, experience ups and downs. For instance, a market downturn might seem daunting, but historically, markets have recovered and grown over time. While short-term investments are more susceptible to fluctuations, remember that a diverse portfolio can mitigate risks. Watching your pension value change can be nerve-wracking, but it’s important to stay focused on the long-term picture. Have you ever checked your pension statement and felt anxious about a dip in value? It’s a common experience, but staying informed about market trends can help ease those worries.Risk And Return Considerations

Every investment carries a degree of risk, and pensions are no exception. Balancing risk and return is key to maximizing the growth of your pension in five years. Higher-risk investments might offer greater returns, but they also come with potential losses. Consider your risk tolerance when choosing how to allocate your pension investments. Are you comfortable with potential short-term losses for the chance of higher gains? If not, opting for a safer, more stable investment might be wise. Reflect on your financial goals and timeline. If you’re nearing retirement, you might prefer less risky options. For younger investors, taking on more risk could lead to greater returns in the long run. Investing in a pension for five years may not seem like much, but understanding its growth potential can help you make the most of your contributions. By staying informed and making strategic choices, you can enhance your financial future even in a short timeframe.Personal Financial Goals

Investing in a pension for just five years can boost your financial future. It provides a foundation for retirement savings. Even short-term contributions can grow over time, giving you more security later.

Setting personal financial goals is crucial when considering whether to pay into a pension for five years. Your goals guide your decisions and help you stay focused on what truly matters. They shape how you allocate your resources and determine the impact of short-term sacrifices on long-term benefits. ###Aligning With Retirement Plans

Is your vision of retirement lounging by a beach or perhaps traveling the world? Aligning your pension contributions with your retirement plans ensures you’re financially equipped to realize those dreams. If five years of contributions can bring you closer to your desired lifestyle, isn’t that worth considering? Many people underestimate how much they’ll need for retirement. Consider your desired lifestyle and calculate the funds required to maintain it. If a five-year pension contribution aligns with your retirement goals, it might be a smart move. ###Balancing With Other Investments

A pension is just one piece of the financial puzzle. Are you also investing in stocks, real estate, or other ventures? Balancing your pension with these investments can diversify your portfolio and reduce risk. Think of your financial future like a well-balanced meal. A little bit of everything can ensure you’re not overly reliant on one source. Evaluate how a five-year pension fits into your broader investment strategy. Consider the potential returns and risks of each investment type. Could a pension complement your other investments while providing a safety net? Balancing these factors can help you make informed decisions about your financial future.Alternative Investment Options

Considering alternative investment options can offer diverse financial growth. Many people explore these options for better returns. Let’s look at some popular alternatives to pensions.

Comparing With Stocks And Bonds

Stocks and bonds are common investment choices. They offer potential growth and income. Stocks represent ownership in companies. Their value can rise with the company’s success. Bonds are loans to companies or governments. They pay interest over time.

Investing in stocks can be rewarding. But it also carries risks. Market fluctuations can affect stock prices. Bonds are generally safer. Yet, they offer lower returns than stocks. Balancing stocks and bonds can provide stability. It helps manage risk and reward.

Real Estate Investments

Real estate is another alternative. It involves buying property. Real estate can provide rental income. Property values may also increase over time. This makes real estate appealing to many investors.

Real estate requires more initial capital. It also involves ongoing costs. Maintenance and property taxes can add up. Yet, many find it a reliable source of income. Real estate can diversify an investment portfolio. It offers both stability and potential growth.

Expert Opinions

Paying into a pension for 5 years can boost retirement savings. Expert opinions highlight potential growth and security. Even short-term contributions can provide financial benefits later.

When considering whether paying into a pension for just five years is worth it, expert opinions can provide valuable insights. Consulting with professionals who have a deep understanding of financial planning can help you make an informed decision. Their advice, coupled with real-life scenarios, can guide you in evaluating whether this short-term investment aligns with your financial goals.Financial Advisors’ Perspectives

Financial advisors often emphasize the importance of starting a pension plan, even if it’s just for a short period like five years. They argue that every contribution counts towards your future security. Many suggest that the power of compound interest can make even a brief investment period beneficial. Advisors might also point out that tax benefits associated with pension contributions can be a significant advantage. These benefits can effectively boost your savings over time. This immediate gain can make a short-term pension plan appealing. Some advisors share stories of clients who were initially skeptical but later appreciated the decision. One advisor recalled a client who, after only five years of contributions, saw a notable difference in their retirement funds. This client felt more secure and confident in their financial future.Case Studies And Real-life Scenarios

Looking at real-life scenarios can help illustrate the potential of a five-year pension plan. Consider Jane, a 40-year-old who decided to contribute to her pension despite planning to retire in five years. By the time she retired, her contributions, along with interest, had grown significantly, providing a buffer she hadn’t anticipated. Another scenario involves Tom, who started late but still saw value in making pension contributions. Even with just five years, Tom was able to accumulate a modest sum, which complemented his other retirement savings. This extra financial cushion allowed him more flexibility in his post-retirement plans. These case studies show that even a short-term investment can lead to meaningful growth. It raises an important question: Could a five-year pension plan be the unexpected boost your retirement strategy needs? Whether you’re considering a pension for the first time or reassessing your current plan, these expert insights and real-life examples highlight the potential benefits. They encourage you to think critically about your retirement strategy and the role a pension could play, even if only for a limited time.

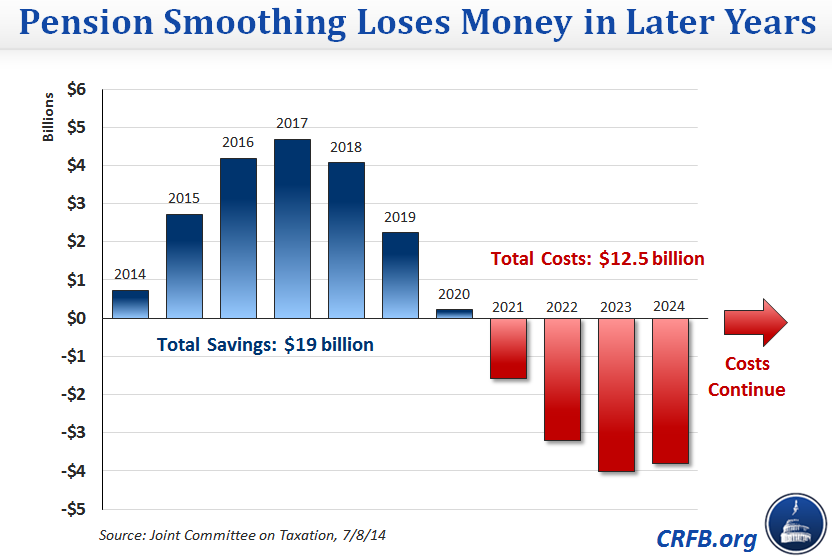

Credit: www.crfb.org

Making An Informed Decision

Making an informed decision about pensions can seem daunting. Many people wonder if investing in a pension for five years is worthwhile. Understanding your options helps you make the best choice for your future. Let’s explore the key factors to consider.

Weighing Pros And Cons

Start with the pros. A pension offers tax benefits. Contributions often reduce taxable income. This means more money stays in your pocket. Pensions also provide a sense of security. They promise a steady income during retirement.

Now, the cons. Pensions can be less flexible. Once invested, accessing funds before retirement age is tough. Market fluctuations can also impact your pension pot. Weighing these points helps you see the bigger picture.

Assessing Personal Circumstances

Consider your current financial situation. Do you have debts? Paying off high-interest debts might be a priority. Do you have an emergency fund? It’s wise to have some savings for unexpected expenses.

Think about your retirement goals. How much income do you need when you stop working? Understanding your goals helps tailor your pension contributions. Age also plays a role. Starting earlier means more time for growth. But it’s never too late to start planning.

Your employment status matters too. Some employers offer pension matching. This can boost your savings significantly. Consider all these factors to make a well-rounded decision.

Credit: www.facebook.com

Frequently Asked Questions

What Are The Benefits Of A 5-year Pension?

Paying into a pension for five years can offer significant benefits. It helps you accumulate savings for retirement and can provide tax advantages. Even a short-term contribution can grow over time, benefiting from compound interest. This can lead to a more secure financial future.

Can A Short-term Pension Impact Retirement Funds?

Yes, even short-term pension contributions can impact your retirement funds positively. They accumulate and grow over time, adding to your total savings. Regular contributions, even for a short period, can help enhance your financial stability in retirement.

Is A 5-year Pension Worth The Investment?

Investing in a pension for five years is generally worth it. It builds a foundation for future savings and offers tax benefits. Contributions grow over time, providing more financial security in retirement. It’s a strategic step for long-term financial planning.

How Do Pensions Grow Over Time?

Pensions grow through compound interest and investment returns. Contributions are invested, and earnings are reinvested, leading to growth. Even short-term contributions can expand significantly over time, providing substantial benefits for retirement.

Conclusion

Choosing to invest in a pension for five years can be beneficial. It helps build financial security for retirement. Saving now offers peace of mind later. Even short-term contributions grow over time. Consider your financial goals and future needs. Small steps today lead to a comfortable tomorrow.

Assess your budget and priorities. Pensions often provide tax advantages. Understand the plan’s terms and benefits. Consult a financial advisor if unsure. Plan wisely for a secure future. Every bit saved makes a difference. Investing in a pension is a smart decision.

Prepare now for a rewarding retirement.