Money is important. We all know that. We want to save money. But saving money is not always easy. There are many ways to save money. One way is called a Lifetime ISA.

What is a Lifetime ISA?

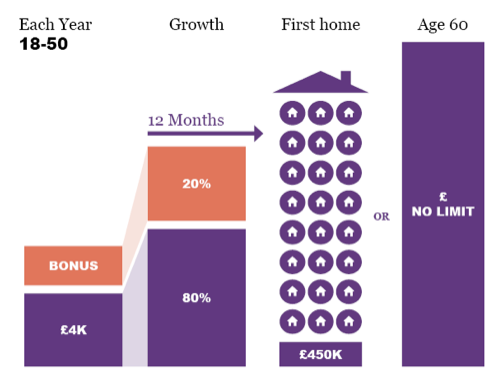

A Lifetime ISA is a special savings account. ISA stands for Individual Savings Account. The government helps you save money with a Lifetime ISA. You must be 18 to 39 years old to open one.

How Does It Work?

When you save money in a Lifetime ISA, the government adds money too. For every pound you save, they add 25 pence. If you save £4,000 in a year, you get £1,000 extra. That is a good deal!

Credit: www.facebook.com

Why Use a Lifetime ISA?

There are two main reasons to use a Lifetime ISA. First, to buy a home. Second, to save for when you are older.

Buying A Home

A Lifetime ISA helps you buy your first home. You can use it to pay for part of the home. This is a great help for young people.

Saving For Old Age

When you are 60 years old, you can use the money for anything. It is like a reward for saving money for a long time.

Benefits of Lifetime ISA

There are many benefits of using a Lifetime ISA. Let’s look at some of them.

- Extra money from the government.

- Good for buying your first home.

- Helps save for old age.

- Tax-free savings.

These benefits can help you reach your money goals.

Credit: m.youtube.com

Are There Any Drawbacks?

Yes, there are some drawbacks too. You must know these before you decide.

Early Withdrawal Penalties

If you take money out early, you pay a fee. This fee can be high. You lose some of your savings.

Contribution Limits

You can only save up to £4,000 each year. This limit may be low for some people.

Age Restrictions

You must be 18 to 39 years old to open one. If you are older, you cannot start a new account.

Who Should Use a Lifetime ISA?

A Lifetime ISA is not for everyone. It is best for young people. If you want to buy your first home, it is helpful. If you want to save for old age, it is good too.

Young Home Buyers

If you are saving for your first home, this is for you. The extra money helps you buy your home sooner.

Long-term Savers

If you want to save for later, this is also good. The money grows over time. You get a nice amount when you are 60.

How to Open a Lifetime ISA?

Opening a Lifetime ISA is easy. Follow these steps:

- Choose a bank or provider.

- Check their offers and fees.

- Open the account online or in person.

- Start saving money.

These steps help you get started with your savings.

Is It Worth It?

Now, the big question. Is a Lifetime ISA worth it? The answer depends on your goals. If you want to buy a home, it is worth it. If you want to save for later, it is worth it.

Consider Your Goals

Think about what you want. If you plan to buy a home, this is a good choice. If you want to save for later in life, this works too.

Look At The Benefits And Drawbacks

Weigh the benefits and drawbacks. If the benefits are more important, then it is worth it. If the drawbacks are too much, it may not be right for you.

Frequently Asked Questions

What Is A Lifetime Isa?

A Lifetime ISA is a savings account. It helps save for retirement or a first home.

How Does A Lifetime Isa Work?

You deposit money into your Lifetime ISA. The government adds a bonus each year.

Can Anyone Open A Lifetime Isa?

No, only UK residents aged 18-39 can open one.

What Is The Government Bonus For A Lifetime Isa?

The government adds 25% to your savings. Up to £1,000 yearly.

Conclusion

A Lifetime ISA can help you save money. It is good for buying a home and saving for old age. The extra money from the government is a big help.

But, there are limits and fees. You must think about these. If you are young and have a goal, it can be worth it. If not, look for other ways to save.

Always think about your goals. Choose the best way to save for you. A Lifetime ISA is one option. It might just be the right one for you.